travel nurse state taxes

Travel Nurse RN - Home Health - 3139 per week Total Med Staffing is seeking a travel nurse RN Home Health for a travel nursing job in Medford New York. Every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every.

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

Travel nurse salary is different for each assignment but it generally comes with a generous hourly rate which is taxable income as well as tax-free stipends for things like housing and.

. From A to Z well take care of it all. Federal income taxes according to your tax bracket. What taxes do travel nurses pay.

During tax season documents are processed within 24 to 72 business hours. Here is an example. A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate.

Top 10 Tax Questions of Travel Nurses What is a tax home. Travel Nurse RN - Home Health - 1432 per week Days. Travel nurse taxes can be especially tricky.

Travel Nurse non-taxable income. This is the most common Tax Questions of Travel Nurses we receive all year. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

The following states and jurisdictions do not have an income tax. If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes. Pay package is based on 8 hour shifts and 40 hours per week subject to confirmation with tax.

Alaska Washington Wyoming Nevada South Dakota Tennessee Texas Florida New Hampshire USVI and. Taxable Income and non-taxable income. To help you navigate your travel nurse.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. These stipends are not taxed since they are classified as. For state taxes remember to file before the April 15th deadline.

For nurses domiciled in a compact state the filing of a resident tax return is universally expected. Quarterly Taxes 1099 employees expecting to owe over 1000 in taxes have. Not just at tax time.

Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Choose from travel nurse jobs in a number of cities across the US such as New York or perhaps you will want to experience working overseas. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

TotalMed Staffing is seeking a travel nurse RN Home Health for a travel nursing job in Medford New York. You may need to pay four taxes as an independent contractor. That will allow you to select your saved files and upload them to us via our encrypted site.

Youre often filing in multiple states and dealing with uncommon concepts like per diems. As a travel nurse you can qualify for non-taxable income called stipends. As a travel nurse there are some deductions that can save you a significant tax.

Also nurses are free to go anywhere in their breaks. This means travel nurses can no longer deduct travel-related expenses such. Job Description Requirements.

Its not enough to simply abandon a residence but establish a new one. It is also the. When filing our taxes all of us are looking for deductions items that lower our tax liability.

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Trusted Event Travel Nurse Taxes 101 Youtube

State Tax Questions American Traveler

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Travel Nurse Tax Faq With The Founder Of Travel Tax Youtube

How To Make The Most Money As A Travel Nurse

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Talking Travel Nurse Taxes The 50 Mile Rule The Gypsy Nurse

How Much Do Travel Nurses Make

Top Tax Deductions For Nurses Rn Lpn More Everlance

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

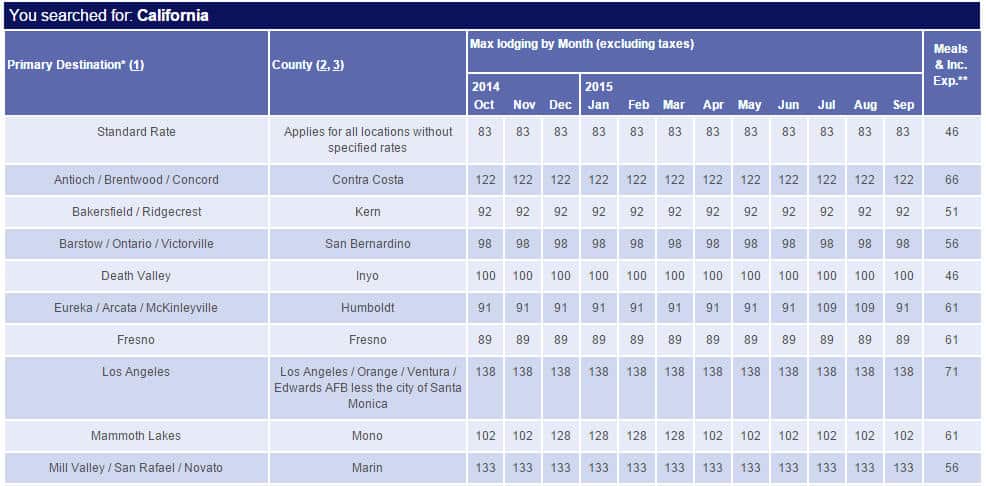

6 Things Travel Nurses Should Know About Gsa Rates

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing